Bookkeeping is the ongoing process of recording a business’s financial transactions in an organized manner. There are various methods for tracking these activities, and accurate recordkeeping is crucial for preparing reliable financial reports and monitoring business performance. Good bookkeeping is also essential if your business faces a tax audit.

Bookkeeping Methods

Before you start, choose a bookkeeping method that fits your business’s size and transaction volume. Smaller businesses may find simple methods sufficient, while larger organizations often need more robust systems to handle their complexity.

Single-Entry Bookkeeping

This straightforward approach records each transaction only once, typically in a cash book. It’s ideal for small businesses or sole proprietors who don’t deal with credit sales or large inventories, and it doesn’t require specialized accounting knowledge.

Double-Entry Bookkeeping

A more comprehensive system, double-entry bookkeeping records each transaction in at least two accounts as debits and credits. For example, a $10 sale increases both your cash and sales accounts. This method helps keep records balanced and is better suited for larger businesses or those that use credit, as it reduces the risk of errors.

Cash vs. Accrual Basis

You’ll also need to decide whether to record transactions when cash is exchanged (cash basis) or when income and expenses are earned or incurred (accrual basis). The cash basis is simpler and often paired with single-entry bookkeeping, while the accrual method works well with double-entry systems and provides a more accurate picture of your finances.

Recording Transactions

Accurate transaction records are the foundation for financial statements like balance sheets, income statements, and cash flow statements. Start by collecting source documents such as invoices and receipts, then record these in journals and ledgers. For very small businesses, a cash register may be enough, but most will need more detailed records.

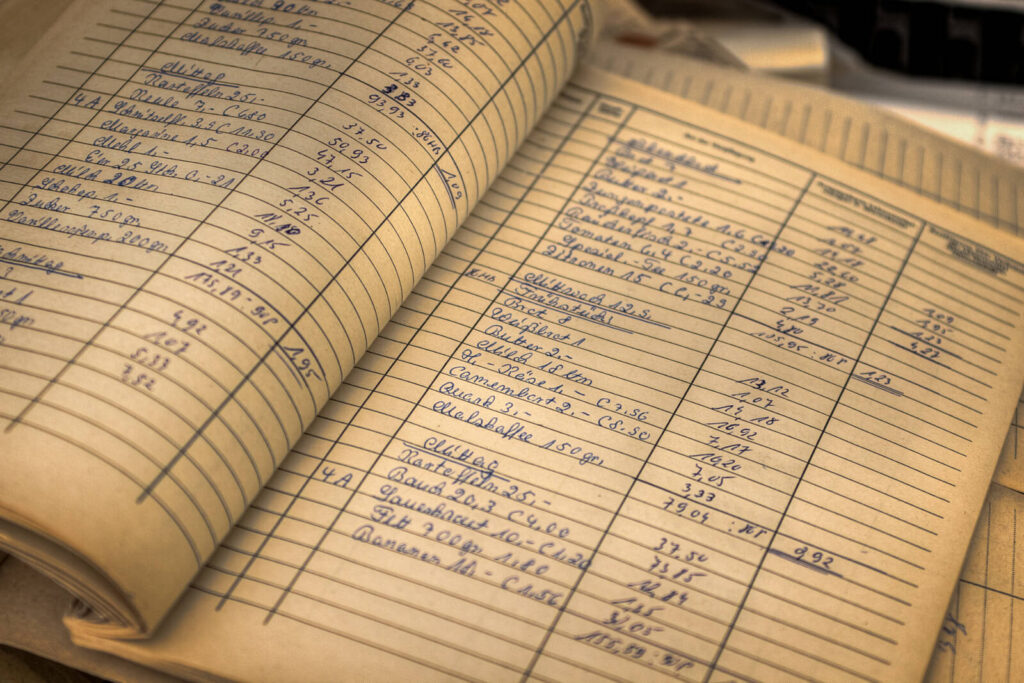

Journals and Ledgers

A journal is where transactions are first recorded in chronological order. These entries are then transferred to a ledger, which organizes them by account type—assets, liabilities, income, and expenses. Ledgers must be balanced at the end of the year to ensure accuracy.

Trial Balance and Financial Statements

A trial balance summarizes all ledger accounts to check if debits and credits match, helping to spot errors early. The main financial statements every business should understand are the cash flow statement, balance sheet, and income statement. These reports provide insight into your company’s performance and financial health.

Bank Reconciliation

Regularly comparing your bookkeeping records with your bank statements helps catch discrepancies, errors, or fraud, ensuring your records reflect your true financial position.

Outsourcing and Offshoring in Bookkeeping

Many businesses today choose to outsource bookkeeping tasks to external specialists or firms, either locally or abroad. Outsourcing allows companies to focus on their core business while experts handle routine accounting functions, improving efficiency and scalability. Offshoring, a type of outsourcing, involves moving bookkeeping operations to another country, often to benefit from lower labor costs and access to a wider talent pool. These strategies not only help reduce costs but also enable businesses to operate across different time zones and scale their support as needed.

Maintaining Good Bookkeeping

Proper bookkeeping is vital for business success. While some small companies still use manual methods, many are turning to digital solutions or outsourcing to streamline their processes and improve accuracy. Whether you handle bookkeeping in-house, outsource it, or offshore the tasks, keeping your records organized and up-to-date is essential for making informed business decisions and supporting growth